What We Do

Norm Williamson, CPA, PLLC is a full-service accounting firm offering tax preparation and planning services to individuals, businesses, estates and trusts. We are committed to working closely with our individual and business clients to help them identify and address the key issues that are critical to their financial success. Quality tax preparation and accounting services are the foundation for more value-added consulting and planning engagements. Every client will receive personalized service that focuses on their unique situation to help them recognize and attain their financial goals.

Individual Services

Tax Return Preparation

We view the tax return not simply as a compliance document, but a foundation for identifying and addressing more comprehensive tax and financial planning needs. We offer a full range of tax preparation services for our individual clients.

Tax Planning

Today's legislative climate provides significant tax planning opportunities. Our comprehensive approach enables us to focus on those issues that impact you directly and develop personalized solutions.

Financial Planning

Our financial planning services help you ensure that you're on the right path to achieving the financial goals that matter. We provide objective advice in areas such as retirement and Social Security planning, college funding, and estate planning. We work closely with other members of your professional team to ensure that your planning needs are being serviced as efficiently as possible.

Business Services

Entity Formation

Selecting the appropriate entity for your new business is a critical first step for every business owner. By focusing on the needs and goals of your business, we are able to assist you in selecting the entity that best addresses those needs and allows you to operate most efficiently.

Business Tax Return Preparation

We provide tax return preparation services for all business entities, from sole proprietorships to corporations, and have experience in a wide range of industries including real estate, construction, and professional service firms.

Business Consulting

At all stages of the business cycle, owners need to ensure that they are identifying key issues and making informed decisions in those areas that directly impact their success. We provide consulting services to assist in cash flow planning, employee benefit program and retirement plan selection, structuring business sale transactions, and planning for the successful transition of the business.

Trusts and Estates

Trust and Estate Income Tax Preparation

Trusts frequently play a critical role in the estate planning process, but present numerous complexities that can make tax compliance a daunting task. Our depth of experience in this area allows us to provide quality tax preparation services for all types of trust and estate returns.

Estate, Gift, and Charitable Planning

Everyone needs an estate plan to ensure that their loved ones are taken care of. Proactive planning and consideration of gifting and charitable strategies helps to maximize the value that your heirs receive by minimizing the potential estate and income tax burdens.

About

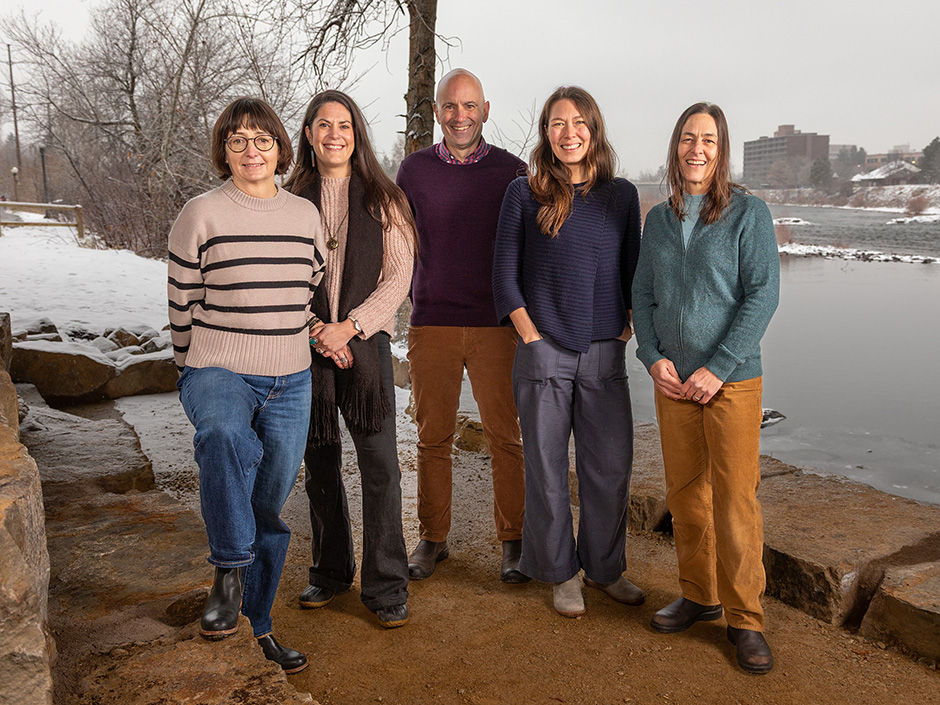

Norm Williamson, CPA

Norm Williamson graduated from the University of Georgia with a Bachelor of Business Administration in 1995. He moved to Montana in 1996 and went on to obtain a Masters of Accountancy/Taxation from Gonzaga University in 1998. Norm then returned to Missoula and began working as a CPA. In October of 2013, Norm started his own firm, where he focuses on tax and financial planning for individuals, small businesses, trusts and estates. In his free time, Norm enjoys exploring the wilds of Western Montana and spending time with his family and friends.

Jamie Herring

Jamie joined our firm in 2014 to help our small business clients navigate their everyday tax and accounting needs. As the preparer for many of our firm’s business tax returns, she prides herself on designing practical, efficient solutions for the unexpected accounting challenges that arise while running a small business. Jamie earned her undergraduate and graduate degrees from the University of Montana and has been licensed as a CPA in Montana since 2009. When she isn’t crunching numbers, Jamie homeschools her two kids with her husband Josh, wanders the steep mountains and cold waters of the Rock Creek drainage, and searches for good laughs and the occasional bird.

Victoria Parks

Victoria Parks has enjoyed preparing tax returns since 1998. She started practicing yoga in 1998 for a parallel balance in life, haha! She likes working on personal taxation and trusts & estates. She holds a University of Florida AA degree. She has a BA in English as well as many business grad-non-degree classes from the University of Montana. She loves her family and Missoula. You can find her playing outside whether it is in her yard or in the woods walking, snowboarding, hiking, hunting, camping or communing. She enjoys reading and games. She also volunteers with community organizations.

Danielle Prosper

Dani is a Missoula native who is thrilled to serve the community that raised her, as well as joining this fantastic firm full of wonderful people. She has myriad experience supporting small businesses as an administrator. She graduated from the University of Montana in 2012 with a degree in English Literature. When outside the office, Dani enjoys cooking, baking, and reading; as well as wrangling her children into the woods of Western Montana to hike, bike, paddle-board, and forage for the awesome goodies our local forests provide.

Jennifer Williamson

Jennifer has over 25 years of experience in the Accounting, HR and IT fields working in the non-profit and education sectors. Prior to joining Norm Williamson CPA, she was the Finance Director for Ecology Project International, overseeing the Finance, Human Resource, Administration and IT departments for 8 years. Throughout her career, she has managed and directed multiple accounting system implementations specializing in Quickbooks, SCT Banner and Adaptive Insights. Her career in finance and accounting includes work as the Finance Director of Missoula Downtown Association and the Accounts Payable manager at the University of Montana. In addition to being a licensed Certified Professional Bookkeeper and QuickBooks Online and Desktop certified, she holds a Bachelor’s degree from Pacific Lutheran University.

Norm Williamson, CPA

Norm Williamson graduated from the University of Georgia with a Bachelor of Business Administration in 1995. He moved to Montana in 1996 and went on to obtain a Masters of Accountancy/Taxation from Gonzaga University in 1998. Norm then returned to Missoula and began working as a CPA. In October of 2013, Norm started his own firm, where he focuses on tax and financial planning for individuals, small businesses, trusts and estates. In his free time, Norm enjoys exploring the wilds of Western Montana and spending time with his family and friends.

Jamie Herring

Jamie joined our firm in 2014 to help our small business clients navigate their everyday tax and accounting needs. As the preparer for many of our firm’s business tax returns, she prides herself on designing practical, efficient solutions for the unexpected accounting challenges that arise while running a small business. Jamie earned her undergraduate and graduate degrees from the University of Montana and has been licensed as a CPA in Montana since 2009. When she isn’t crunching numbers, Jamie homeschools her two kids with her husband Josh, wanders the steep mountains and cold waters of the Rock Creek drainage, and searches for good laughs and the occasional bird.

Victoria Parks

Victoria Parks has enjoyed preparing tax returns since 1998. She started practicing yoga in 1998 for a parallel balance in life, haha! She likes working on personal taxation and trusts & estates. She holds a University of Florida AA degree. She has a BA in English as well as many business grad-non-degree classes from the University of Montana. She loves her family and Missoula. You can find her playing outside whether it is in her yard or in the woods walking, snowboarding, hiking, hunting, camping or communing. She enjoys reading and games. She also volunteers with community organizations.

Danielle Prosper

Dani is a Missoula native who is thrilled to serve the community that raised her, as well as joining this fantastic firm full of wonderful people. She has myriad experience supporting small businesses as an administrator. She graduated from the University of Montana in 2012 with a degree in English Literature. When outside the office, Dani enjoys cooking, baking, and reading; as well as wrangling her children into the woods of Western Montana to hike, bike, paddle-board, and forage for the awesome goodies our local forests provide.

Jennifer Williamson

Jennifer has over 25 years of experience in the Accounting, HR and IT fields working in the non-profit and education sectors. Prior to joining Norm Williamson CPA, she was the Finance Director for Ecology Project International, overseeing the Finance, Human Resource, Administration and IT departments for 8 years. Throughout her career, she has managed and directed multiple accounting system implementations specializing in Quickbooks, SCT Banner and Adaptive Insights. Her career in finance and accounting includes work as the Finance Director of Missoula Downtown Association and the Accounts Payable manager at the University of Montana. In addition to being a licensed Certified Professional Bookkeeper and QuickBooks Online and Desktop certified, she holds a Bachelor’s degree from Pacific Lutheran University.

At Norm Williamson CPA, we focus on building strong personal and professional relationships by working to find solutions and meet the needs of our clients and colleagues.